- Average house prices up more than £4,000 so far this year

- Eight authorities also reach new highs

- Sales activity starts to recover

- Average Scottish house price now at £224,977, up 1.1% on March, up 2.9% annually

Scott Jack, Regional Development Director at Walker Fraser Steele, comments:

“House prices in most of Scotland have risen sharply in recent months, rising by more than £2,000 in March and again in April. The average house price in Scotland is currently just under £225,000, which is both a record high and a significant increase from the peak it reached in September 2023. This stands in contrast to Wales’s and England’s markets.

“Nineteen local authorities reported growing prices during the month, easily outnumbering those reporting decreases (twelve). No less than eight local authorities saw prices hit new market highs, despite the net positive balance being slightly lower than in March.

“All housing markets are driven by sentiment and Scotland appears to have turned the corner in terms of both prices and transactions, according to our data. This upswing in confidence is a result of growing salaries, falling inflation, and the anticipation that interest rates will start to come down later this year.

“Consumer sentiment is therefore more buoyant but so is that of mortgage lenders who have been able to lend at higher LTVs, which has improved the situation for first-time buyers and other borrowers facing affordability stretches.

“The Scottish housing market is poised for success in the remaining months of 2024.”

Detailed commentary:

Housing market commentary

After languishing over the past year, house prices across much of Scotland have picked up smartly in recent months, rising by more than £2,000 in March and again in April. Scotland’s average house price now stands just shy of £225,000 – its highest ever level and comfortably above its previous peak in September 2023. This contrasts with the still lacklustre housing markets across England and Wales.

While we have updated our transaction weights and seasonal adjustment factors this month, these changes have modestly depressed our estimates of price levels, as a result of a lower proportion of detached sales in our weightings. As the impact of these adjustments on price changes is likely to be marginal, we can be confident that the reported upturn in house price inflation is genuine.

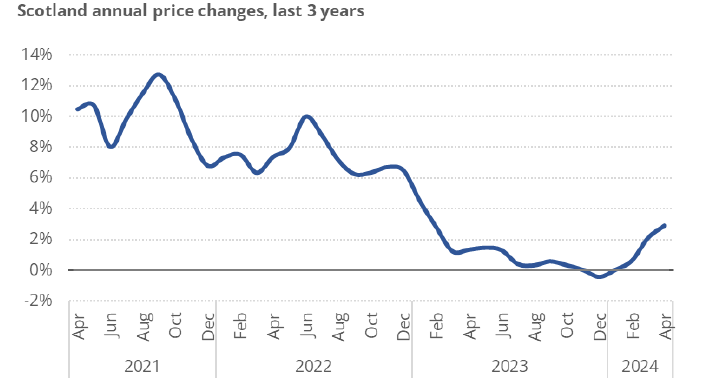

Figure 1. Weakness in prices appears to have ended

Prices increased by more than £2,500 in April and were 2.9% higher than a year earlier, as Figure 1 shows. This is the strongest performance since the start of last year.

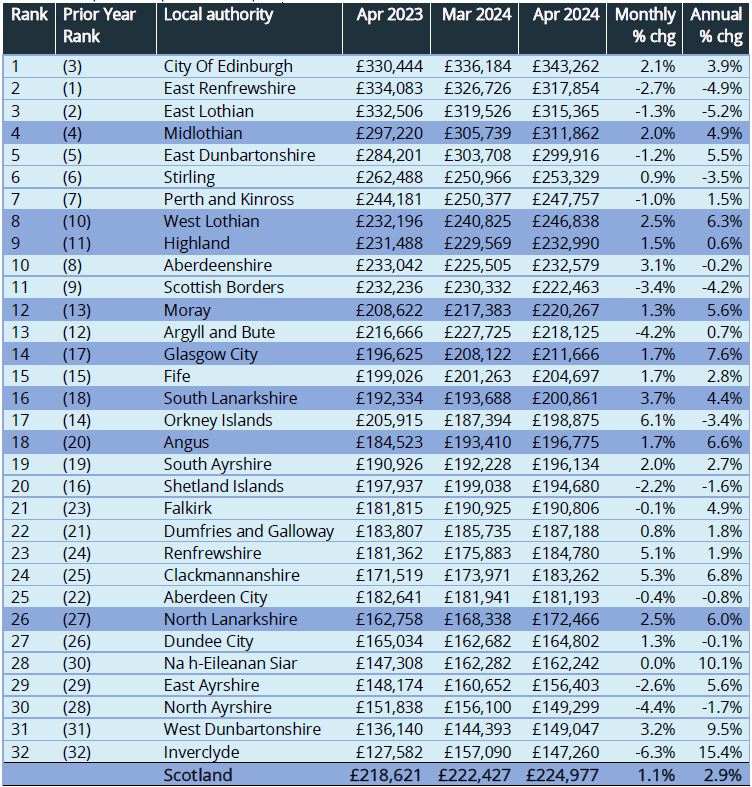

Table 1. Average prices in Scotland for April 2023 – April 2024

Local Authority prices

Table 2. How prices in April 2024 compare

Note: Lines shaded in darker blue reflect cases where Local Authority or Scotland prices reached record highs this month.

The number of local authorities experiencing rising prices in the month (19) comfortably exceeded those seeing a decrease (12), with one – Na h-Eileanan Siar – effectively treading water.

Although the net positive balance is marginally less than in March, there were no fewer than eight local authorities where prices were reaching new market highs (see Table 2).

Higher prices were less evident in higher-priced housing areas, with only Edinburgh and Midlothian among the five most expensive local authorities reporting price increases in April.

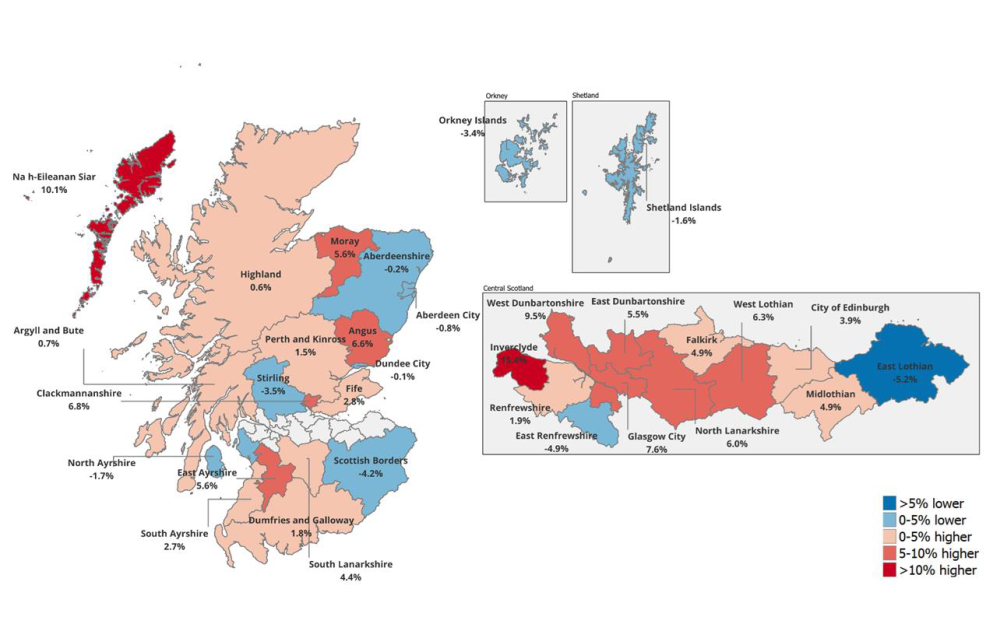

Figure 2. How prices have changed between April 2023 and April 2004, by local authority

As can be seen from the heat map, in April the vast majority of local authorities (22) reported stronger prices than a year ago, the highest number for just over a year. Among the “risers”, half reported price increases of at least 5% over the year.

Transactions analysis

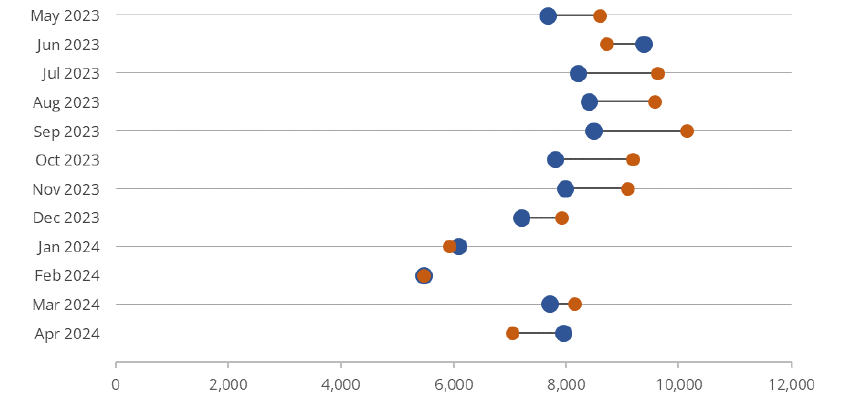

Figure 3. Monthly sales over the most recent 12 months compared with a year earlier

Note: March and April 2024 figures are Acadata estimate, based on the Registers of Scotland figures for the Date of Entry

In terms of transactions, the housing market has been lacklustre over much of the past year. For 2023 as a whole, sales totalled 91,700 properties, which is 12% down on 2022 and not much above the Covid-induced lows of 2020.

As the headwinds have eased over the past few months, helped by more attractive mortgage pricing and easing cost-of-living pressures, monthly sales are no longer lagging materially below year-earlier levels (see Figure 3).

A positive shift in market sentiment helped lift sales in January marginally above those in January 2023 and sales in February closely tracked year-earlier levels. While we do not yet have complete figures for more recent months, March looks like it will dip a little below last year but April looks set to outpace the year-earlier tally by a comfortable margin.

And as we noted last month, sales of property in the capital and of properties worth more than £750,000 (that is, subject to the highest rates of LBTT) have been ahead of their corresponding 2023 numbers since the turn of the year.

This report does suggest the market has now turned a corner in terms of both prices and transactions. Some uncertainties do remain and there will almost certainly be some volatility. However, with rising wages, falling inflation and a realistic expectation that interest rates will begin to fall later this year market confidence has grown and along with it, enquiries and listings. That in turn has helped lenders back into higher LTV lending which in turn boosts the prospects for first-time buyers and others facing affordability pressures. Any uncertainty that the General Election introduces regarding governments in Scotland and the UK should clear in the next few weeks. Taken in the round the Scottish housing market seems set fair for the remaining months of 2024.

Comments