- Housing market builds positive momentum

- Prices are just 1.6% lower than a year ago

- Wales and the North East move into positive territory

- Southern England plays catch-up

- Average house price now at £360,175 up 0.4% on May, 1.6% down annually

Richard Sexton, Director at e.surv, comments:

“Our data shows an improving picture for the market in England and Wales and one that we expect to further improve over the coming months. In June, the average sale price of a home in England and Wales climbed by nearly £1,500 (0.4%) to £360,175. This is the strongest performance for nearly a year. Prices are now within 5% of the previous peak reached in October 2022. June’s 1.6% decrease was a full percentage point improvement on May and the strongest performance since July 2023.

“Of course, within that there are regional stories. The 1.6% year-on-year decrease in house prices seen across England and Wales almost disappears if we exclude London and the South East. The North East and Wales continue to lead the charge in improving house price performance.

“Going forward, in light of the Labour win, we should see further improvements in buyer sentiment as the government sets out to deliver on its manifesto pledges. These are ambitious and will take time but include creating a number of New Towns, rethinking the green belt, mandatory targets for Local Authorities, a Freedom to Buy Scheme, and a pledge to lower the stamp duty threshold for first-time buyers in April 2025.

“Also, we may now see action from the Bank of England on interest rates, given the improving inflation picture, which will improve affordability for buyers.”

Detailed analysis

The housing market in June 2024

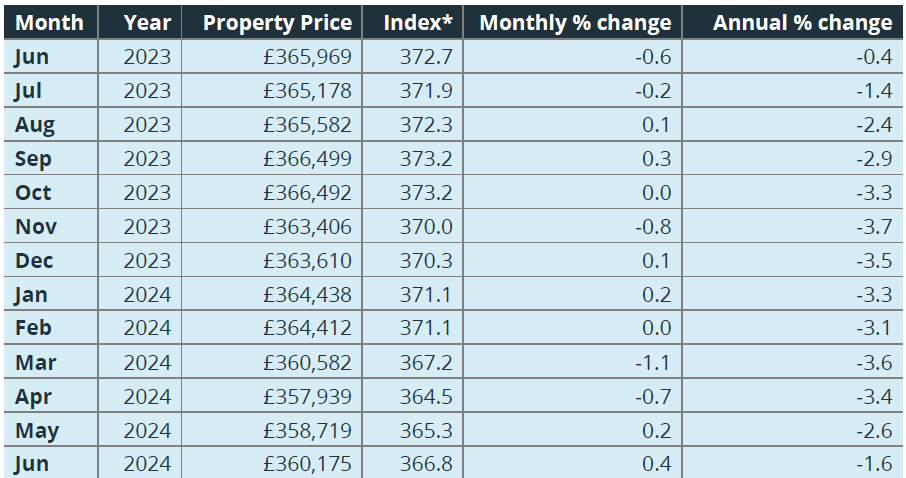

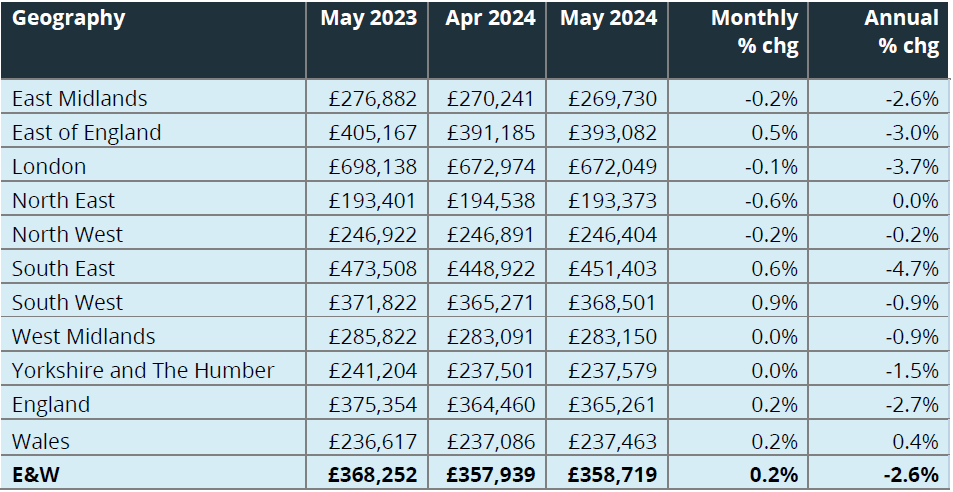

Table 1. Average House Prices in England and Wales for the year to June 2024

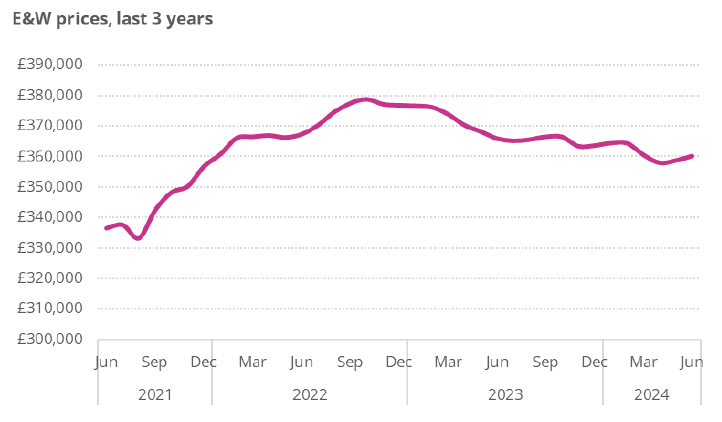

Figure 1. The average monthly house price in England and Wales

In June 2024, the average sale price of a home in England and Wales climbed by nearly £1,500 (0.4%) to £360,175. This is the strongest performance for nearly a year. Prices are now within 5% of the previous peak reached in October 2022.

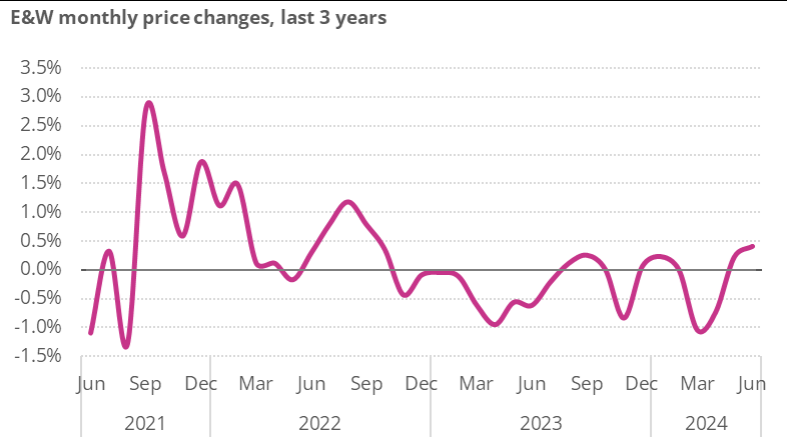

Figure 2. Monthly price movements back in positive territory

Although there is always considerable volatility in month-on-month movements, as Figure 2 shows, June’s 0.4% increase builds on a smaller increase the month before. Against the backdrop of easing cost-of-living pressures for many households and the growing prospect of interest rate reductions by the Bank of England possibly later this summer, this may well herald the start of a more significant and lasting pick-up in market conditions.

While year-on-year comparisons are still in negative territory, June’s 1.6% decrease was a full percentage point improvement on May and the strongest performance since July 2023.

By the time this release hits the press the General Election will be behind us and almost certainly there will be a period of increased confidence and less uncertainty. This will help the housing market move forward. May’s RICS housing market survey identified a mix of trends across England and Wales but new instructions were up and price expectations over the next 3 months were also up and, drilling down, the outlook for Wales was notably more positive than across the English regions.

With new governments in England and Wales of whatever hue, we can expect to see a renewed focus on housing supply and the planning system along with further help to home buyers and not least via the mortgage guarantee scheme which supports higher LTV lending. In addition, lenders have been responding to falling mortgage lending, for example mortgage approvals dipped below 60,000 in May for the first time since the start of the year, by cutting rates again and launching new products.

Taken in the round, we can see a degree of positive momentum building in the housing market. This will inevitably take time but of course once the seeds of recovery become more entrenched so the pace of movement will pick up. This would suggest that as we move into the autumn and one of the peak buying periods there should be a degree of forward momentum though still capped by the on-going affordability squeeze. Further new supply and more rethinking around Stamp Duty and its equivalent in Wales will then need to be factored into the equation. However, for the moment and bearing in the mind the evidence presented in this release we are beginning to see a more stable pattern of recovery emerging.

The English Regions and Wales

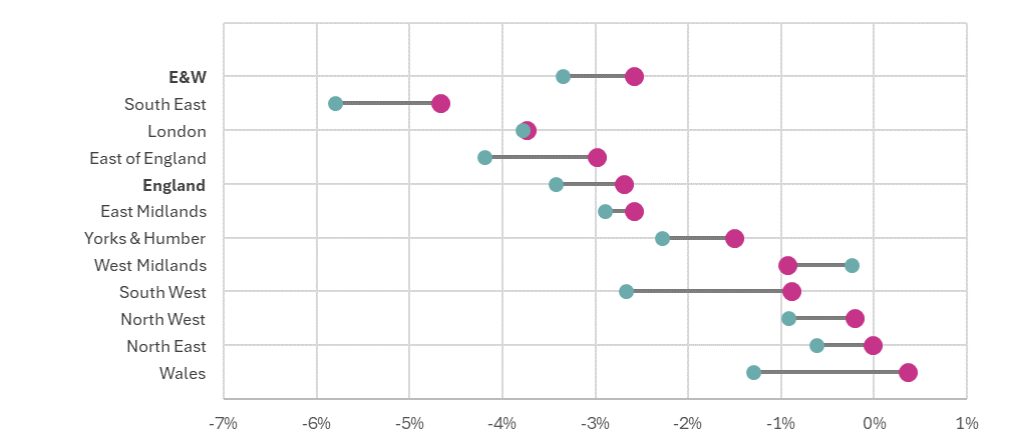

Figure 3. How annual price comparisons changed between April and May

Figure 3 shows the percentage change in annual house prices for England and its regions and Wales in May 2024 (pink circles) and a month earlier in April 2024 (blue circles).

In May the West Midlands was the only English region where the year-on-year price comparison moved unfavourably, albeit prices there remain within 1% of what they were a year ago.

The big picture here is that signs of price weakness continue to dissipate across most of England and Wales. According to the May data, prices in Wales are once again increasing year-on-year while broadly static in the North East and North West England. We also observe a sharp improvement in the South West, where prices are now within 1% of year-earlier levels. Whilst the proportion of unitary authorities and counties reporting higher prices year-on-year is somewhat higher in the North East and Wales, there are early signs that all four of these regions may turn positive in June.

Figure 3 also offers clear signs of a north-south (in essence an expensive v less expensive) divide, with much of southern England showing the weakest price trends and struggling to recover. This reflects the much higher house price levels, stretched affordability and greater reliance on debt finance in this part of the country.

Table 2. Average Prices in the English regions and Wales, May 2024

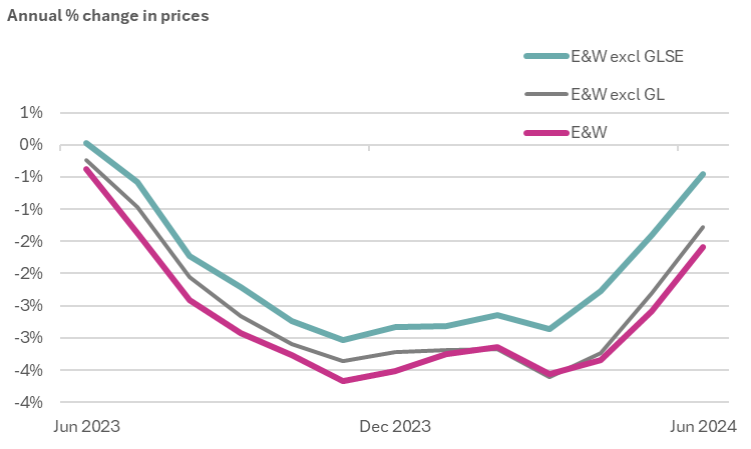

As the headline table at the start of this report points up, the 1.6% year-on-year decrease in house prices seen across England and Wales almost disappears if we exclude London and the South East. Over recent months it is the South East region rather than the capital that has been the most significant drag on the overall performance of the market (see Figure 4). Within the South East, Surrey, Kent and West Sussex account for half of the downward pressure in South East prices. On a positive note, these and other home counties will benefit the most as and when UK interest rates start to decline.

Figure 4. Weakness in South East drags England & Wales lower

Comments