The air continued to slowly come out of the prime London property market in June.

It is a process that began last summer as inflation approached double digits and it became clear that interest rates were heading back towards their long-term average of closer to 5% than 1%.

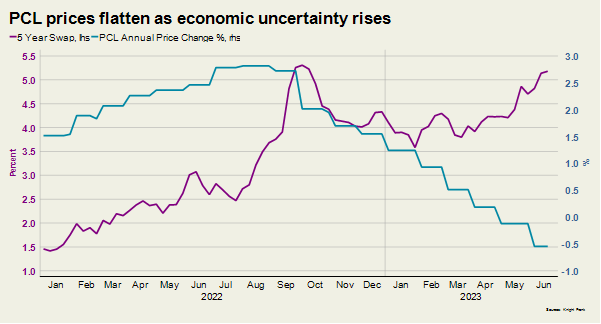

There was no palpable sense of distress, but the economic mood music became more sombre. Buyers hesitated and annual price growth gradually descended to zero over the following 12 months, as the chart shows.

September’s mini-Budget was an unwelcome but brief jolt to the system but a nasty inflation reading last month sent interest rate expectations higher again.

The Bank of England has faced criticism for doing too little too late, especially after a second consecutive high number last week.

Mortgage costs have spiked and speculation around falling prices has mounted but has there been any impact on the prime London market over the last month?

Yes, but not a particularly dramatic one. The economic mood has darkened but the market is far from grinding to a halt.

The number of new prospective buyers in London over the most recent four-week period was 24% above the five-year average.

The resilience is perhaps no surprise given that around half of sales inside zone 1 are typically in cash.

The market will also be supported by greater levels of affluence, the relatively weak pound (depending on your timing) and the fact overseas travel is returning to pre-Covid levels.

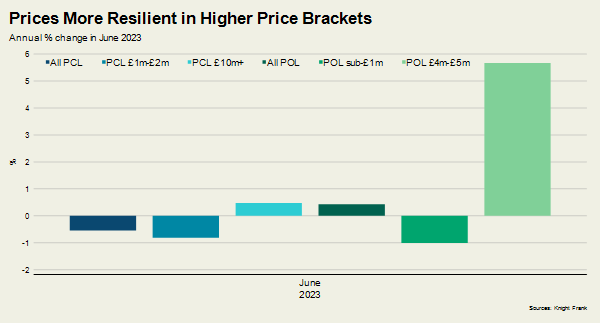

Higher price-brackets have certainly proven more robust as activity tends to be less reliant on mortgage debt, as the chart shows.

And overall, activity in London is stronger than outside the capital, where there is a less discernible post-pandemic economic bounce.

However, recent mortgage market volatility is likely to accelerate a price correction in the capital.

Sensitivity around asking prices is higher than it was just a month ago and nervousness among lenders is rising.

The latest Knight Frank forecasts are here.

That said, there will be a cushioning effect from strong wage growth, record levels of housing equity, amassed lockdown savings, the availability of longer mortgage terms, forbearance from lenders and the popularity of fixed deals in recent years.

The opposing forces of natural market resilience and rising economic uncertainty means that prices are likely to keep deflating for the rest of this year, but only slowly.

Comments