There has been a bang crash wallop of troubling economic signs this week, which may keep tensions high round the table at Bank of England’s monetary policy committee today.

Members know full well that the economy needs to be weaned off the drug of cheap money, not least to give them options to treat any future crises and to keep a lid on inflation.

But an interest rate rise any time soon, could tip many borrowers over the edge and into more debt, and put a further break on recovery.

Already consumers were faced with rising prices in the shops, but now energy hikes are on the cards as soaring gas prices lead to the collapse of smaller cheaper providers.

As well as the supply chain crisis, exacerbated by a shortage of labour and bottle necks at ports, the energy crunch is now feeding the fires of inflation.

There was a bigger than expected rise in the consumer price index which shot up to 3.2% in July and the bank has already warned that the only way is up for prices over the coming months.

The crux of the issue is whether these rises are transitory, a mantra which the MPC have overall stubbornly stuck to.

Although it increasingly looks like inflation will linger for longer, most committee members are still likely to sit firmly on their hands and play a waiting game until well into next year, even when it comes to rolling back the mass bond buying stimulus programme.

As the US central bank, the Federal Reserve hinted yesterday though an earlier rise than previously expected could be on the cards next year, and there could be indications that the tapering of the asset purchases may be brought forward.

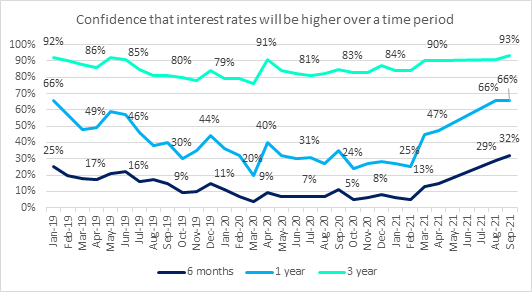

The HL investor confidence survey for September showed that confidence that interest rates are going to be higher has risen this month, across short & long term, with two thirds of investors now expecting a rate rise within a year*.

But with weaknesses in supply chains exposed, jitters continuing about a property meltdown in China, and stubbornly high infection rates in many parts of the world, there is a now distinct drag on economic recovery.

This will stop the MPC stepping on the pedal today to accelerate away from the era of ultra cheap money.

*The investor confidence index is compiled by surveying clients on a monthly basis. Each month Hargreaves Lansdown send the investors’ confidence survey to 6,000 random clients and there is a representative split of our clients by age. On average 10% of clients respond (around 600 clients).

Clients are asked to say how likely they are to invest in a certain sector over time frames of 6 months, 1 year and 3 years, by selecting Very Likely, Likely, Neither Nor, Unlikely or Very Unlikely.

Comments