For full details and technical commentary & analysis, please see the attached pdf.

- Annual change still negative at -2.9%

- Price falls are getting smaller

- North West now closest to a positive rate

- South East has biggest fall in annual rates at -6.6%

- Transactions are at lowest levels since 1995

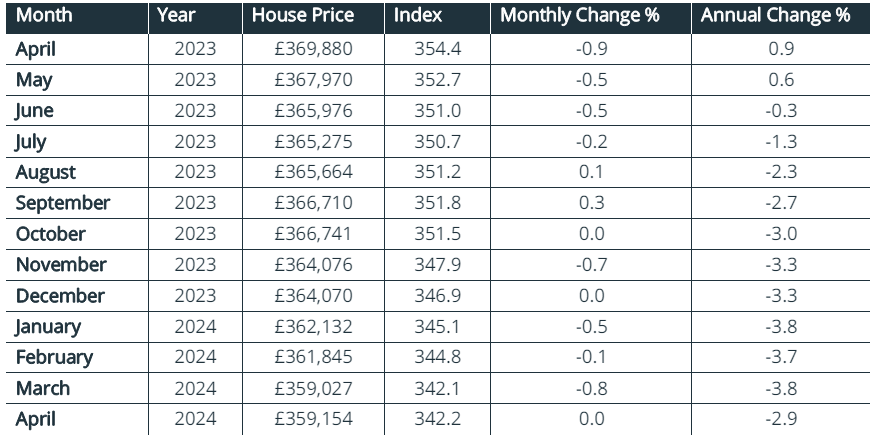

- Average House Price (England and Wales) £359,154, down 2.9% annually

Richard Sexton, Director at e.surv, comments: “Our index points to a fragile recovery this month. The average sale price of completed home transactions using cash and/or mortgages in England and Wales rose by a meagre £127 to £359,154.

“This means that the average sale price in April is £18,920 lower, or 5%, below the peak reached in October 2022, but crucially some £43,750 – or 13.9% – higher than at the start of the pandemic in March 2020, over 4 years ago.

“The expectation that any Bank of England base rate cut is imminent is becoming an increasingly distant prospect. This pushed mortgage rates higher in April and has undoubtedly given some buyers’ pause for thought.

“So while increased competition from lenders has meant that the availability of mortgage finance has been good, going forward, we expect the dual effect of economic and political uncertainty (in advance of the general election later in the year) to weigh on buyer sentiment over the coming months which may, in turn, weigh on price growth.”

Table 1. Average House Prices in England and Wales for the period April 2023 – April 2024

Comments